GBP JPY TJ, 1st setup

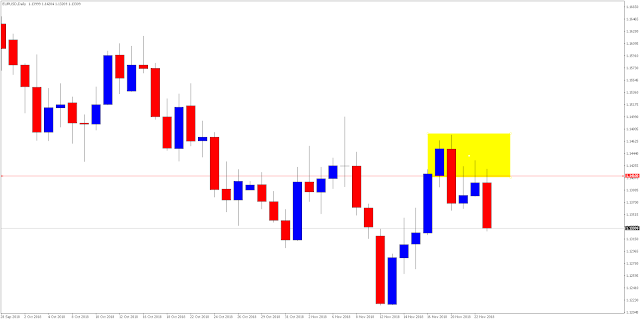

Rabu - 22/8 Ternampak 2 Resistance zone / previous high di antara 129.375 dan 129. 325 dengan pagi ni antara jam 7 dan 8 am candle menjadikan LH terbaru di 129.3 dan adanya reversal point, maka entry SELL dibuat di h1 jam 9am. Target adalah di 129.00, dan seandai price break ke bawah sebelum 8 jam pertama, maka akan berlaku terjunan. SL adalah di 129.35 / 129.4 dan intraday TP di 129.00 Kita akan lihat perkembangan seterusnya dalam tempoh 3 jam akan datang ni samada price akan reject di antara zon area 129.00 untuk create LOD atau sebaliknya If LOD terbentuk, maka akan mencari peluang buy di kemudian waktu pula.